As a rideshare driver in New York City, whether you drive for Uber, Lyft, or another platform, understanding TLC (Taxi and Limousine Commission) insurance is essential. Unlike standard personal auto insurance, TLC insurance is designed specifically for commercial drivers and meets the unique requirements set by the New York City Taxi and Limousine Commission. In this guide, we’ll explain why TLC insurance is necessary, the types of coverage it includes, and how it protects both you and your passengers.

What Is TLC Insurance?

TLC insurance is a mandatory commercial auto insurance policy required by the New York City Taxi and Limousine Commission for all vehicles operating for hire. This type of insurance is designed to provide the necessary protection for vehicles, including rideshare cars, while they are in service, covering liability and damage that may occur during the course of transporting passengers.

Why Is TLC Insurance Required?

Driving for Uber or Lyft in New York City without TLC insurance is against the law. The TLC enforces strict regulations to ensure that both drivers and passengers are protected. Having the proper TLC insurance coverage not only keeps you compliant with local regulations but also safeguards you financially in the event of an accident or other unforeseen incident.

Key Coverages in TLC Insurance

- Liability Coverage

- Bodily Injury Liability: If you are at fault in an accident and someone is injured, this coverage helps pay for medical expenses, lost wages, and legal costs. The minimum required coverage is $100,000 per person and $300,000 per accident.

- Property Damage Liability: This coverage helps cover the costs of repairing or replacing property you damage in an accident. The minimum required coverage is $200,000.

- Personal Injury Protection (PIP)

Also known as no-fault insurance, PIP ensures that medical expenses and lost wages for you and your passengers are covered, no matter who is at fault in the accident. This ensures quick access to funds for medical treatment without the need to establish fault.

- Uninsured/Underinsured Motorist Coverage

If you’re involved in an accident with a driver who lacks adequate insurance, this coverage helps pay for your medical expenses, lost wages, and other damages.

- Collision and Comprehensive Coverage

- Collision Coverage: Pays for damages to your vehicle resulting from an accident, regardless of who is at fault.

- Comprehensive Coverage: Covers damages to your vehicle caused by non-collision incidents such as theft, vandalism, fire, or natural disasters.

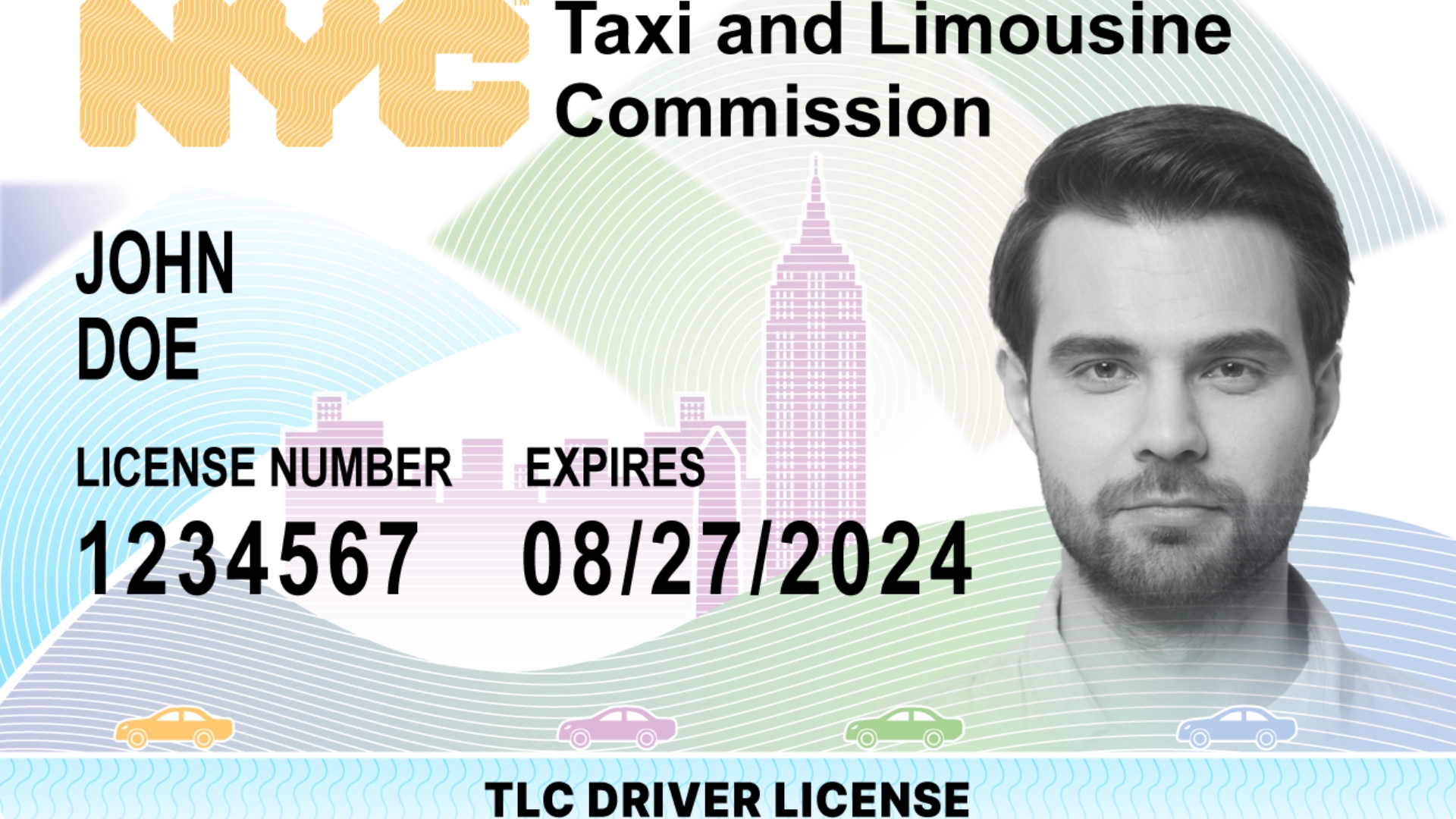

The FH-1 Insurance Certificate

The FH-1 certificate is an essential document in TLC insurance. This certificate verifies that your vehicle is properly insured and must be issued by a licensed New York insurance company. You must keep this certificate up to date in order to maintain your TLC license and continue operating legally as a rideshare driver.

What Affects TLC Insurance Premiums?

TLC insurance premiums can be higher than regular auto insurance because of the increased risk associated with commercial driving. Several factors can influence how much you’ll pay for your coverage:

- Driving History: A clean driving record with no accidents or violations typically results in lower premiums.

- Vehicle Type: Newer vehicles with advanced safety features may result in lower insurance rates.

- Driver Affiliation: Drivers affiliated with major rideshare companies like Uber often pay less for insurance than those operating independently.

- Experience: More experienced drivers with a history of safe driving may qualify for lower rates.

Tips for Lowering Your TLC Insurance Premiums

- Maintain a Clean Driving Record: Safe driving habits will keep your premiums lower and help prevent costly accidents.

- Choose a Safe Vehicle: Selecting a car with good safety ratings and lower repair costs can reduce your insurance costs.

- Consider Higher Deductibles: Opting for a higher deductible can reduce your premium, but make sure you can afford the out-of-pocket expenses if you need to file a claim.

- Review Your Policy Regularly: Stay in contact with your insurance provider to make sure your policy remains competitive and covers your needs as they change.

Conclusion

TLC insurance is not just a legal requirement for Uber, Lyft, and other rideshare drivers in New York City—it’s an essential safety net that protects you, your passengers, and others on the road. By understanding the different components of TLC insurance, you can ensure compliance with NYC regulations while securing the coverage you need to drive with confidence.

For the best TLC insurance options and personalized assistance, get in touch with Asian Insurance today. We specialize in providing tailored coverage for rideshare drivers, ensuring you get the protection you need at competitive rates.